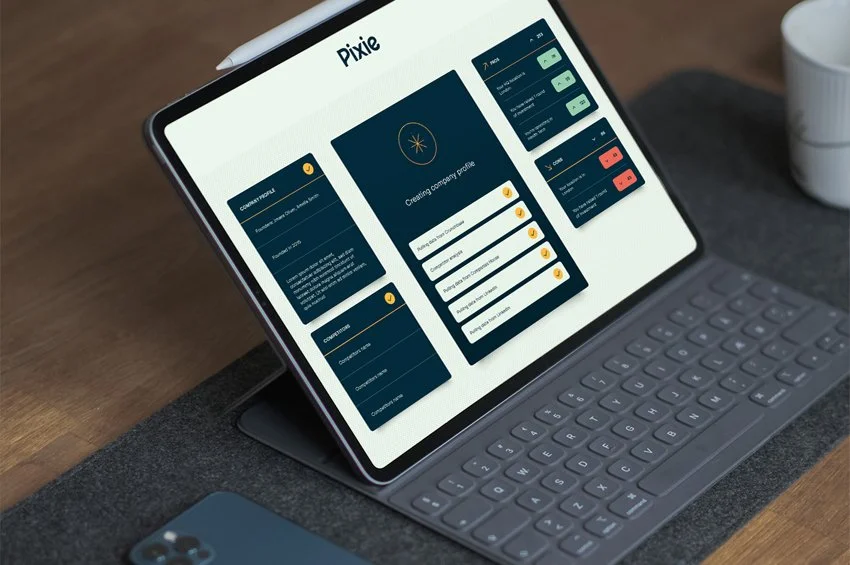

Pixie is Portfolio Scaling Intelligence

We've cracked the scale-up code.

Now your portfolio intelligence includes systematic scaling predictors alongside your proven investment methodology.

Pixie addresses the fundamental inefficiency in early-stage investment: 90% of promising startups fail to scale, representing massive unrealised returns.

We've systematically decoded why the 10% succeed—creating the first predictive framework for scaling success..

Portfolio companies using ScaleUp DNA analysis demonstrate stronger scaling fundamentals and clearer growth trajectories. You get objective scaling potential scores alongside your proven due diligence methodology.

Pixie delivers systematic de-risking through ScaleUp DNA analysis.

Every portfolio company receives a scaling intelligence score based on empirically validated traits of successful scale-ups.

Like a credit score for scaling potential, this provides objective, measurable criteria beyond traditional due diligence and portfolio management methods.

Progress monitored, trajectory mapped

Presuming they have a promising score and you take them on, Pixie continues to work alongside the start up – providing them with a roadmap to achieve the growth outcomes that you have mutually signed up to.

Systematic scaling intelligence provides real-time performance tracking against ScaleUp DNA benchmarks. Portfolio companies receive evidence-based guidance calibrated to their scaling trajectory, with systematic alerts when key scaling indicators require attention - ensuring systematic navigation rather than reactive management.

Systematic portfolio performance enhancement

Our methodology targets the £150bn scaling inefficiency through systematic intelligence. Portfolio companies demonstrate measurable improvements in scaling velocity and success probability through evidence-based decision-making rather than intuitive scaling approaches.

EIS qualification amplifies systematic advantage

Pixie qualifies for full EIS relief: 30% immediate tax relief plus CGT exemption provides 61.5% downside protection on systematic scaling intelligence investment.

Systematic portfolio advantages

Enhanced due diligence through objective scaling potential assessment

Reduced portfolio risk via systematic performance prediction

Accelerated scaling velocity through evidence-based guidance

Measurable improvement in portfolio scaling success rates

ScaleUp DNA analysis adds systematic scaling intelligence to your proven investment methodology - additional data that strengthens portfolio decision-making and enhances scaling performance across your investments.