Our story…

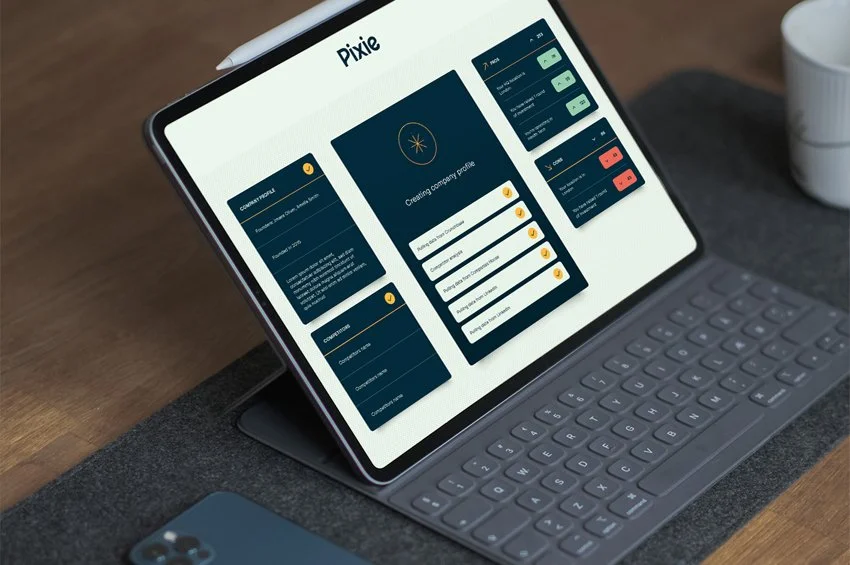

Pixie is more than software. It's a movement to make scaling fair. And unlock potential.

If you're a founder navigating the danger zone - where momentum meets complexity - we're building this for you.

If you believe innovation deserves the right to succeed, regardless of networks, geography, or elite access - we're building this with you.

If you're ready to swap flying blind with start scaling systematically - discover your ScaleUp DNA.

Let's crack the scale-up code together.

Democratise opportunity.

And prove that scaling success isn't luck - it's systematic.

Welcome to Pixie.

It all began in a log cabin in the Dolomites.

A guy with a purpose. A view to die for. And a killer idea…

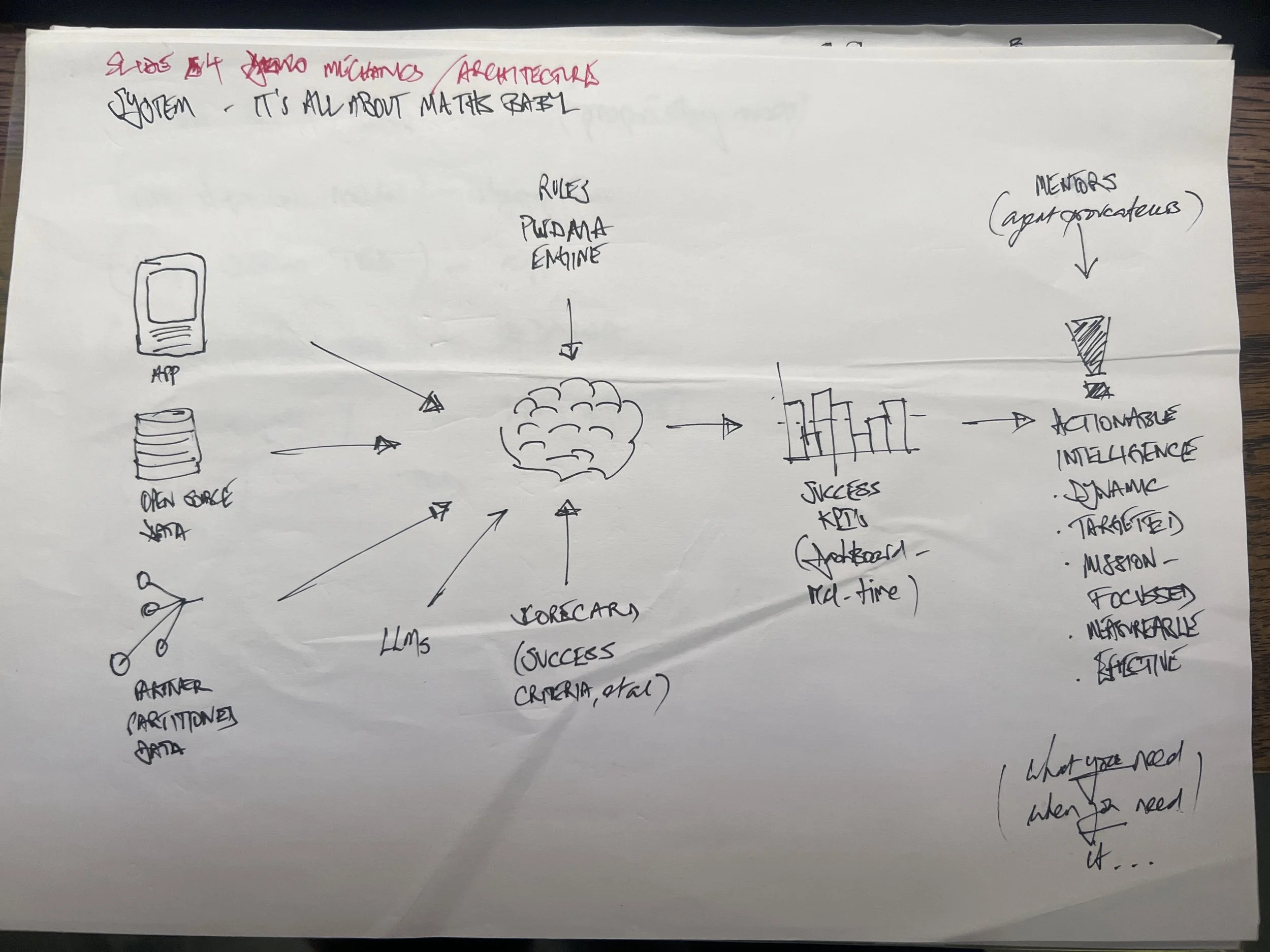

Harness the power of data science powered by generative AI. Leverage cloud infrastructure. Build a platform for startups to run like scale-ups.

Because there's a truth - empirically proven…

Startup outcomes align with the common characteristics, traits, and decisions of successful scale-ups.

But the technology simply didn't exist.

Not at scale. Supporting borderless delivery at marginal cost. Critical for a scaleable business model capable of unlocking vast reserves of global potential.

Armed with some mischievous curiosity, Fuelled by Italian sausages. Encouraged by close family and treasured friends. And with the support of brave investors - alongside the mighty power of Google - the concept of Pixie took form.

But that was just the beginning….

We’re talking epic pools of data…

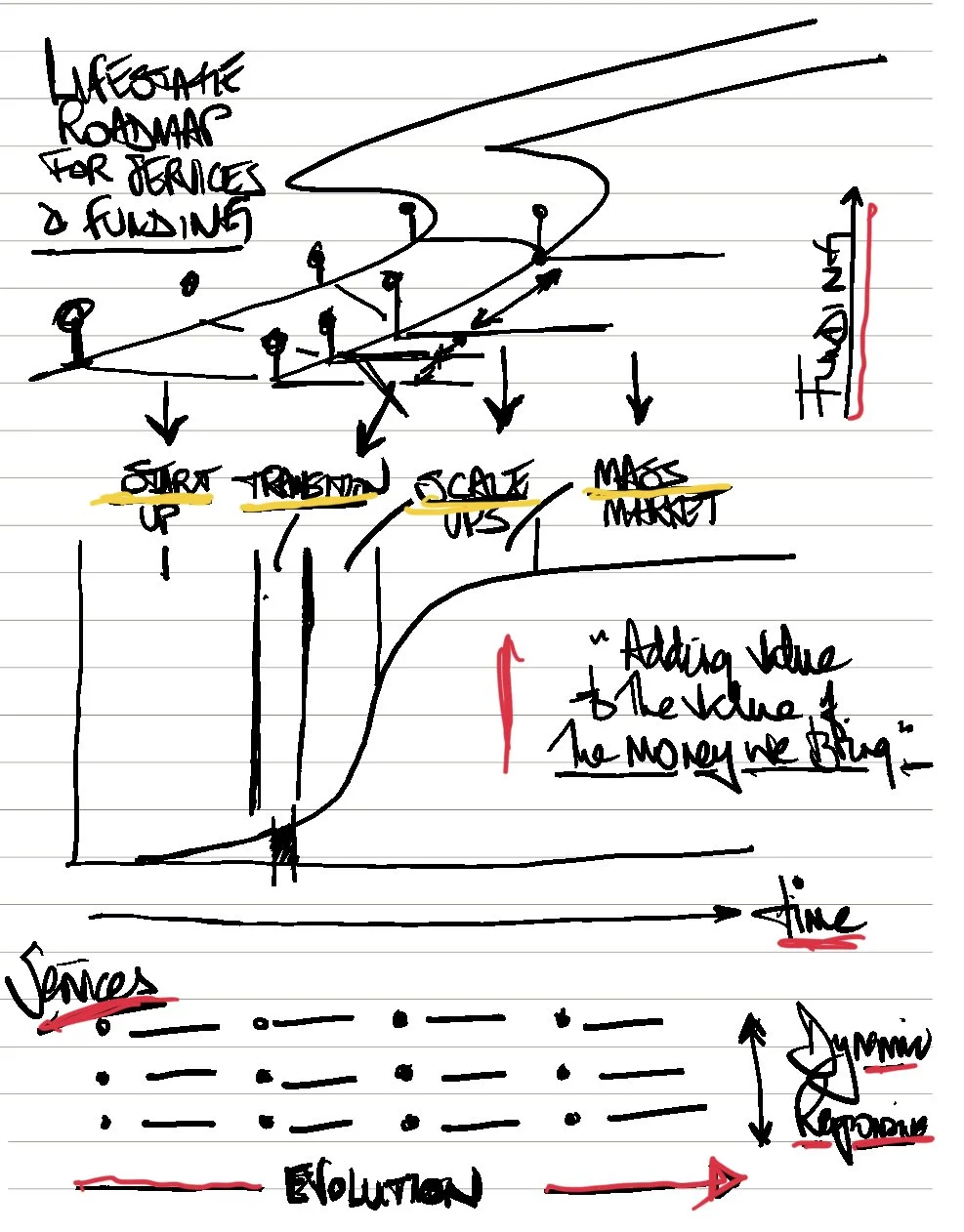

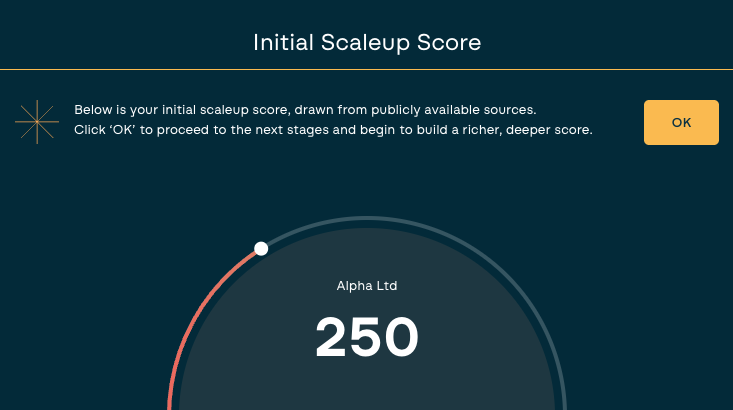

A systematic way to measure scale-up potential.

Immutable scaling laws exist - behaviours, traits, and decisions that materially impact scale-up outcomes.

They've just never been calibrated. Made visible. Harnessed and unleashed at scale.

Traditional startup ecosystems date from a time of talking cars, bionic men and moonshot culture.

Big personalities picking big winners (very occasionally).

So, armed with frontier technology and an entrepreneur's mindset, we started from scratch - with a blank sheet of paper.

(yes, this is the actual one!)

A fresh approach was long overdue.

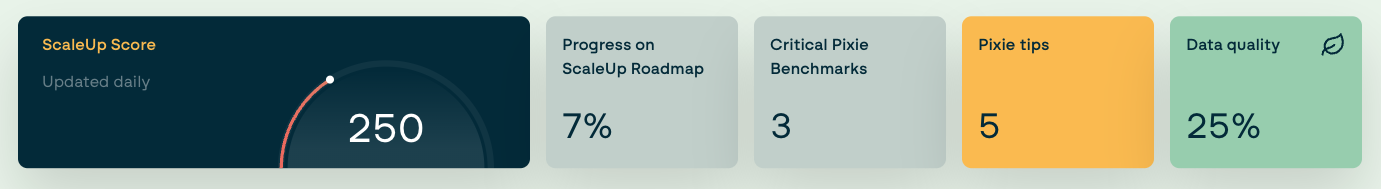

It's data science powered by generative AI - 250,000+ data points, real-time analysis, dynamic growth navigation, multi-modal interfaces - that changes the equation.

Growth management at the atomic level. On a grand scale.

Who we are

The systematic scaling intelligence platform that's improving the odds for founders.

We've cracked the scale-up code. Not through guesswork or generic advice, but by sequencing the DNA of successful scale-ups: the measurable traits, decisions, and patterns that separate systematic success from predictable failure.

We're a team of entrepreneurs, data scientists, AI engineers, and pattern spotters who believe scaling shouldn't feel like flying blind. So we built the SatNav founders wish existed sooner.

Why we exist

Most startups don't fail at launch. They fail in years 2-5.

Not all from bad ideas. But many from predictable causes.

Missed market signals. Cash pressure. Team strain. The very signals that could be seen, measured, and acted upon - if founders had the right intelligence at the right time.

Yet the ecosystem tolerates a 5% scaleup rate as if it's inevitable. Consultants charge for generic frameworks. VCs demand equity for access. And founders are left to navigate complexity alone.

Innovation deserves a better shot.

We exist to democratise scaling intelligence. To make the insights once locked in elite networks accessible to every ambitious founder. To tilt the odds, systematically, in favour of those building the future.

Because just a 0.1% improvement in the global scale-up rate means 75,000 additional scale-ups. That's not just numbers - that's jobs, breakthroughs, and possibilities unlocked.

Our story

Pixie didn't start in a boardroom.

It started with a pattern.

Our founding DNA traces back further than most realise.

For decades, across industries and continents, we've watched scaling unfold - sometimes brilliantly, often brutally. From finance to advertising, luxury property to fintech, food e-commerce to AI - the cycle repeated: founders making thousands of decisions, most without systematic guidance, many colliding with preventable failure. And we had front row seats.

To 1980s desktops and writing code (because there was no software!).

To 25 years navigating Asia's emerging markets. Running data-driven frequent flyer programs. Building direct to consumer channels for Dell and Bosch. Launching the Palm Pilot!

To Lotus F1 family roots, where telemetry and marginal gains meant the difference between winning and losing.

To ventures built in partnership with iconic entrepreneurs and creatives — will.i.am, Alastair Little and the inimitable Mohan Singh Oberoi - who taught us that audacity without system is just noise.

One truth crystallised - scaling patterns are measurable, but no one was measuring them systematically.

We've lived the reinvention cycles founders face. We've felt the exhilaration of momentum and the sting of stalling.

What if we could crack the code and sequence ScaleUp DNA?

What if we treated startup success like F1 treats lap times - obsessively measurement, molecular tuning, grinding out 1% gains across thousands of decisions?

What if we harnessed data science and generative AI to decode what's hidden. Surfaced what matters, when. And engage Founders in socratic dialogue so they are engaged with thier data, rather than drowning in it?

These were the questions that inspired Pixie.

Not one founder's vanity project. A systematic solution to a large yet stubborn challenge

Built by a brilliant team. Committed to one mission: make scaling systematic, not serendipitous.

Our mission

Systemise scaling so more startups realise their potential.

Small gains. Big impact.

We’re big fans of atomic power. British Cycling went from zeros to heroes, 1% at a time. Our rowers struck gold making their boat go faster, one stroke at a time.

Across your scaling journey - hiring, pricing, positioning, resource allocation - each decision you make - data-driven, systematically guided.

A typical scaling journey involves 5k+ decisions. Make each one 1% better and you’ve 10x’d your baseline.

Socratic curiosity

We assume nothing, consider everything. Insights emerge when data meets context, when patterns reveal what you might not see alone.

And we speak from the heart: innovation is mankind’s greatest privilege. The world’s startup ecosystem currently unlocks just 5% of its potential. At this rate failure isn't just inevitable - it's unacceptable.

We're here to change it.

Let’s talk …