Portfolio Scaling

We've cracked the bigger picture.

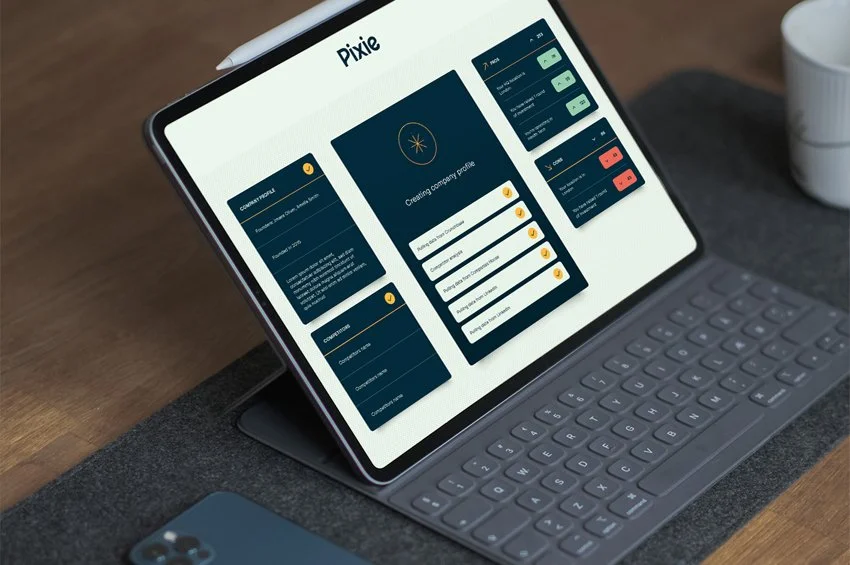

Portfolio Intelligence. Systematic edge.

80%+ of VC-funded startups fail to scale

Pixie is your asymmetric advantage.

Startups on Pixie adhere more closely to scaling fundamentals - giving your portfolio the edge.

Pixie addresses the fundamental inefficiency in early-stage investment. Alongside VC evaluations and fund management advantages, Pixie delivers a returns boost of transformational magnitude. Data-driven de-risking through fundamental analytics and predictive modelling.

Systematic de-risking through fundamental analytics and predictive modelling.

You get cost-effective surveillance across the fund — optimising for growth and identifying mid-tier opportunities at the best price points for a flatter yield curve. Dealflow evaluation leaps in efficiency, with Pixie providing the early rubric: robust intelligence based on validated patterns of successful scale-ups.

A level of data-driven, real-time insight previously unavailable for pre-Series A startups.

Progress monitored. Trajectory mapped.

Once you invest, Pixie continues to work alongside the startup - providing them with a roadmap to achieve the growth outcomes you've mutually agreed.

Real-time scaling intelligence provides performance tracking against ScaleUp DNA benchmarks. Portfolio companies receive evidence-based guidance calibrated to their scaling trajectory, with automated alerts when key scaling indicators require attention - ensuring proactive navigation rather than reactive management.

Portfolio enhancement

Our methodology targets the substantial scaling inefficiency in early-stage investment. Portfolio companies demonstrate measurable improvements in scaling velocity and success probability through evidence-based decision-making rather than intuitive approaches.

EIS amplifies Pixie advantage

Pixie qualifies for full EIS relief: 30% immediate tax relief plus CGT exemption provides 61.5% downside protection on systematic scaling intelligence investment.

Portfolio benefits

Enhanced due diligence through objective scaling potential assessment

Reduced portfolio risk via predictive performance analytics

Accelerated scaling velocity through evidence-based guidance

Measurable improvement in portfolio scaling success rates

ScaleUp DNA analysis adds scaling intelligence to your proven investment methodology - additional data that strengthens portfolio decision-making and enhances scaling performance across your investments.

Let’s talk …